How to Choose the Right Cryptocurrency for You

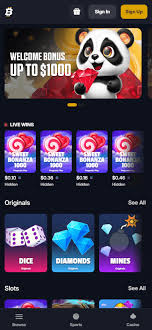

Choosing a cryptocurrency can be a daunting task, especially with thousands of options available in the market. Whether you’re a seasoned investor or a complete beginner, finding the right crypto asset that aligns with your financial goals is crucial. In this guide, we’ll walk you through the most important factors to consider when selecting a cryptocurrency, including How To Choose a Crypto Slot Provider in 2026 Bitfortune com for insights on the best crypto opportunities.

Understand the Basics of Cryptocurrency

Before diving into the details of selecting a cryptocurrency, it’s essential to grasp the fundamental concepts behind it. Cryptocurrencies are digital assets that use cryptography for security and operate on a technology called blockchain. Familiarizing yourself with terms such as wallets, exchanges, and public/private keys is critical to navigating the crypto landscape effectively.

Identify Your Investment Goals

What do you want to achieve by investing in cryptocurrency? Are you looking for long-term gains, quick profits, or diversifying your existing portfolio? Your investment goals will significantly influence your choice of cryptocurrency. For example:

- If you seek long-term investment, consider established coins like Bitcoin or Ethereum.

- If you prefer short-term trading, you might focus on altcoins with higher volatility.

Research the Cryptocurrency Market

Conduct thorough research on the different cryptocurrencies available. Look for metrics such as market capitalization, trading volume, historical performance, and community engagement. Visiting reputable financial news sites and following crypto influencers on social media can provide valuable insights into ongoing market trends.

Evaluate the Technology Behind the Cryptocurrency

The technology that powers a cryptocurrency can significantly impact its long-term viability. Consider the following aspects:

- Blockchain Technology: Is the underlying blockchain innovative, scalable, and secure?

- Development Team: Research the team behind the cryptocurrency. Are they experienced and transparent with their roadmap?

- Use Case: What problem does the cryptocurrency solve? A well-defined use case can indicate potential demand.

Check the Community and Development Activity

A strong and active community often indicates a healthy cryptocurrency. Check the following:

- Visit forums and social media platforms such as Reddit and Twitter to gauge community sentiment.

- Check the development activity on platforms like GitHub to see if the project is continuously evolving.

Assess the Risk Factor

Investing in cryptocurrency is inherently risky. Factors such as regulatory changes, market volatility, and technological issues can significantly affect your investment. Diversification can help mitigate risk. Don’t invest more than you can afford to lose and consider spreading your investment across multiple cryptocurrencies.

Consider Security Features

Security is paramount in the crypto world. Ensure that the cryptocurrency you choose has robust security features. Research past security incidents, and look for information on how the project protects its users’ funds. Additionally, consider hardware wallets for storing your assets safely.

Look at Regulatory Compliance

It’s important to invest in cryptocurrencies that comply with regulations in your jurisdiction. Understanding the legal framework surrounding a cryptocurrency ensures that you’re making a safe and informed investment. Regulatory scrutiny can influence the credibility and longevity of a project.

Examine Exchanges and Accessibility

Not all cryptocurrencies are available on every exchange. When choosing a cryptocurrency, ensure it’s listed on reputable exchanges to facilitate buying, selling, and trading. Additionally, check if the cryptocurrency is available for purchase using fiat currency or if you need to first acquire another digital asset.

Monitor Market Trends and Sentiments

The cryptocurrency market is influenced by various factors, including technological advancements, market trends, and global events. Continuously monitor the market to stay updated. Following market analysts and subscribing to cryptocurrency news platforms will keep you informed about factors affecting your investment.

Start Small and Build Your Portfolio Gradually

For newcomers, it’s advisable to start with small investments in a few cryptocurrencies that you’ve researched. Gradually build your portfolio as you gain more experience and confidence in your investment choices. Regularly review and adjust your portfolio based on market conditions and your financial goals.

Wrapping Up

Choosing the right cryptocurrency involves thorough research and understanding of your personal investment goals. By evaluating the technology, community, risks, and regulatory compliance, you can make informed decisions that suit your investment strategy. Remember that investing in cryptocurrency is a journey—stay informed, be patient, and let your research guide your decisions.